ZAKAT AND USHR

Zakat and Ushr Ordinance 1980

In Pakistan, Zakat Councils are responsible for collecting and distributing Zakat and Ushr. The Ministry of Religious Affairs overseas the Zakat Councils. The collection and distribution of Zakat and Ushr system was enforced in 1980.

What Does Zakat Mean?

Zakat is an Islamic finance term referring to the obligation that an individual has to donate a certain proportion of wealth each year to charitable causes. Zakat is mandatory for all Muslims in most countries and is considered to be a form of worship. Giving away money to the poor is said to purify yearly earnings that are over and above what is required to provide a person and their family with their essential needs.

How Zakat Works

There are Five Pillars of Islam: the declaration of faith, prayer, fasting during Ramadan, the Hajj pilgrimage, and zakat. Zakat is a compulsory procedure for Muslims who earn above a certain threshold. It should not be confused with Sadaqah, the act of voluntarily giving charitable gifts out of kindness or generosity.

Religious texts offer comprehensive descriptions of the minimum amount of zakat that should be distributed to those less fortunate. It generally varies, depending on whether wealth came from the farm produce, cattle, business activities, paper currency, or precious metals like gold and silver.

Zakat is based on income and the value of possessions. The common minimum amount for those who qualify is 2.5% or 1/40 of a Muslim’s total savings and wealth.

The recipients of zakat are:

- The poor and needy

- Struggling Muslim converts

- Enslaved people

- Individuals in debt

- Soldiers fighting to protect the Muslim community

- Those stranded during their travels

Zakat vs. Nisab

Nisab is a term that often appears alongside zakat. It is a threshold, referring to the minimum amount of wealth and possessions that a Muslim must own before being obligated to pay zakat. In other words, if personal wealth is below this minimum during one lunar year, no zakat is owed for that period. The nisab is set at the value of 87.48 grams of gold or 612.36 grams of silver.

Not everyone pays zakat at the same time. That’s where nisab comes into play. Individuals become eligible to pay zakat once they reach the threshold during the full lunar year. So one individual may owe it earlier than someone else.

There is no set payment date for zakat. But it is often paid out at the end of the year once calculations on any leftover wealth are made. Some Muslims believe that paying zakat during Ramadan brings good fortune.

This requires that individuals take regular inventory of their possessions and wealth. This can be done either weekly or monthly.

What Is Zakat in Islam?

Zakat is an Islamic financial term. As one of the pillars of the faith, it requires all Muslims to donate a portion of their wealth to charity. Muslims must meet a certain threshold before they can qualify for zakat. The amount is 2.5% or 1/40 of an individual’s total savings and wealth. Zakat can be paid at any time during the lunar year. Some Islamic countries require citizens to pay zakat while others do not.

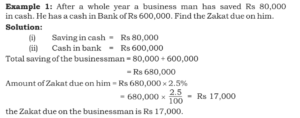

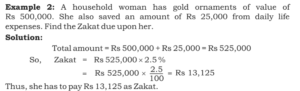

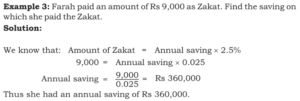

How Do You Calculate Zakat?

Muslims should take inventory of their possessions and wealth. Once they reach nisab or the threshold, which is the value of 87.48 grams of gold or 612.36 grams of silver, they must pay zakat. The total amount to be paid is 2.5% or 1/40 of their total savings and wealth. Muslims can use any number of zakat calculators which are available online to determine their obligations.

What Are the Rules of Zakat?

Individuals must meet a certain threshold known as nisab in order to qualify for zakat every lunar year. This is set at the value of 87.48 grams of gold or 612.36 grams of silver. People whose wealth exceeds the value of these amounts must pay 2.5% of the value of their wealth in zakat. Individuals who do not meet this limit are not obligated to pay.